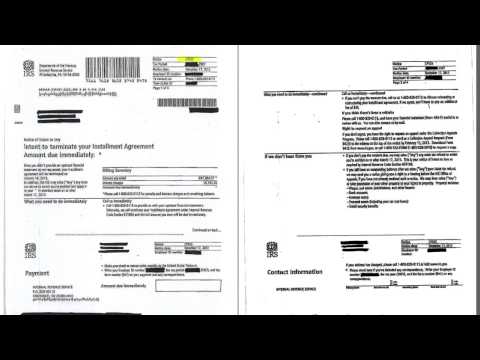

An IRS form CP 523 is typically sent to a taxpayer after they have defaulted on their installment agreement in some way. As you can see from this example on page 1, which is on the left-hand side of your screen, the individual failed to provide updated financial information as requested by the IRS. This is sometimes a requirement in installment agreements, particularly partial pay installment agreements, where the taxpayer is unable to fully pay the liability within the life of the collection statute of limitations. If you don't understand that concept, don't worry too much about it. Basically, it means that in certain installment agreements where the payment is too low to fully pay within 10 years, the IRS will re-evaluate the financial situation and the taxpayer's ability to pay every two years or so. There are a couple of other reasons why we see CP 523s being issued. These include missed payments, late payments, bounced checks, or defaults in some other way. Sometimes, the IRS can get quite imaginative in how they choose to default an installment agreement. For example, we have seen cases where a taxpayer with very large liabilities fully pays a particular year, say they owe $10,000, but they still have other liabilities. The IRS has taken to defaulting these installment agreements, even though the taxpayers have upheld their end of the bargain. Fortunately, reinstating the installment agreement is usually not that difficult. It typically requires a phone call, although sometimes these calls can take an hour or more, which can be a hardship for taxpayers and a source of annoyance for them. There is one important thing to note about most CP 523s, and that is that there is a deadline of 30 days from the date of the letter for you to appeal. You can...

Award-winning PDF software

14039 instructions Form: What You Should Know

S. Internal Revenue Service's (IRS) Online Payroll Services. The online version of the corporation income tax return only requires the following fields of data to be filled out: the corporation's name, 2 the corporation's taxpayer identification number (TIN), for a corporation filing its return electronically under IR-50, see Section 3 of the Instructions for Form 1120-U, U.S. Corporation Income Tax Return, and the section of the return where the corporation's return is due. If you do not obtain a response from the employer within 20 business days of requesting the TIN on your tax return, return the unreturned form without filing Form 1120-A, and send all payment by check. See Form 1120-A, U.S. Corporate Income Tax Return, for detailed instructions and instructions for filing electronic returns electronically. See Form 1120-S (S corporation) for filing, payment, and records requests for a tax return made on paper or by telephone. See the Instructions for Form 1120-S (S corporation) for electronic filing information.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14039, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14039 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14039 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14039 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 14039 instructions